Nonprofit Tax

GHJ is one of the premier accounting firms serving tax-exempt entities in Southern California.

GHJ is one of the premier accounting firms serving tax-exempt entities in Southern California. By providing a full range of tax services to tax-exempt entities, GHJ helps clients set expectations and plan for the future. GHJ's tax-exempt specialists serve public charities, supporting organizations and private foundations with year-round tax planning and tax advisory.

Additionally, GHJ's specialized Nonprofit Tax Team is available for consulting in unrelated business income tax, tax exemption, private foundation excise taxes, entity structure, intermediate sanctions, charitable giving and substantiation, audit representation, independent contractor issues and state and local taxes.

To learn more about GHJ's Nonprofit Practice, please click here.

Helping Further Your Mission

At GHJ, we are committed to helping nonprofit organizations thrive by offering tailored tax solutions and valuable educational resources. GHJ’s specialized team provides comprehensive support to ensure your nonprofit remains compliant and maximizes its impact. Explore the various ways GHJ can assist your organization:

GHJ’s expert team is dedicated to helping you achieve your goals with precision and efficiency. Service offerings include:

- IRS Forms 990, 990-T and 990-PF

- Other State Returns, Registrations and Renewals

- Preparation and Review for Tax Exempt Organizations

- Proactive Tax Planning including public support projections and Research

- State and Local Tax

- State of California Forms 199, 109 and Attorney General Form RRF-1

- International Tax Compliance Requirements

GHJ believes in empowering nonprofit organizations through continuous education.

- Stay ahead of the curve with GHJ’s Annual Nonprofit Accounting and Tax Webinar.

- Sign up for The GHJ's Advisor (the firm's bimonthly digital digest) to stay updated on the latest tax regulations and strategies for nonprofits.

Choosing GHJ for your nonprofit tax needs comes with numerous benefits, including:

- Expertise: GHJ’s team is composed of highly experienced professionals dedicated to nonprofit tax services to ensure you receive the most knowledgeable advice.

- Comprehensive Support: GHJ provides end-to-end support, from tax planning to audit representation to cover all aspects of nonprofit tax needs.

- Tailored Solutions: GHJ understands the unique challenges faced by nonprofits and offer customized solutions to meet your specific needs.

- Proactive Approach: GHJ’s proactive approach ensures you stay ahead of regulatory changes while minimizing risks and maximizing opportunities.

- Commitment to Excellence: GHJ strives for excellence in all services to deliver high-quality outcomes that support your organization's mission.

- Educational Resources: GHJ offers valuable resources, including an Annual Nonprofit Accounting and Tax Update, to keep you informed about the latest tax regulations and strategies.

- Year-Round Assistance: Unlike seasonal tax services, GHJ provides year-round support to help you plan and navigate complex tax issues throughout the year.

Who We Serve

- Arts Organizations

- Charter Schools

- Childcare Programs

- Community Service Organizations

- Counseling Centers

- Environmental Organizations

- Family Health Clinics

- Foster Family Agencies

- Legal Aid Organizations

- Membership Organizations

- Mental Health Clinics

- Museums

- Non-public Schools

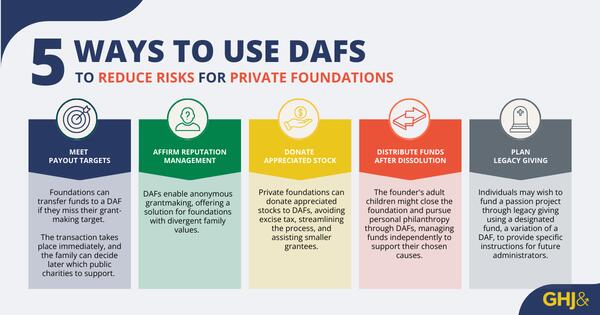

- Private Foundations

- Residential Facilities

- Senior Service Organizations

- Statewide Associations