A passion for clients. An innate curiosity. David Horwich has both of these qualities and, combined, they allow him to have a dogged interest in helping clients solve challenges. David’s special skill is analyzing ways to optimize business performance and increase shareholder value. He does that in a very particular way: he offers nearly 30 years of investment banking and consulting perspective, which enables him to strategically work as a business advocate for his clients. By providing personalized service and building long-term relationships he is able to help position clients for the future.

Why should you care about growth? Growth strategies aren’t only for companies considering an M&A strategy. Shareholder value always matters, but when an exit is imminent, value is exponentially important. According to a recent Harvard Business Review article, nearly 60% of M&A outcomes fail to create value. Why is that? The article goes on to articulate how too few companies do the upfront analysis to understand how to exploit existing profitable business models to optimize growth and profit.

This is where someone like David Horwich comes in. I asked David if I could interview him to better understand how he helps clients create value in their businesses, and how business leaders need to better prepare for future outcomes, whether it involves immediate M&A plans or not.

MAK: David, terms like “growth” and “value” get thrown around all the time. Give me a snapshot on why having a strategy to achieve both really matters to clients.

David: Our team holistically guides clients in order to create value in their businesses. As value is created, owners of privately held companies have an increasing number of options available to them to unlock that value for themselves. Value, broadly defined, is what an owner might realize from their ownership; unlocking value comes from selling some or all of the business in a transaction. Value is created by a business being better managed or operated, resulting in a more profitable company, even if the owner doesn't sell any or all of the business. Everything we do is helping our clients discover ways to create value through sustainability and scalability.

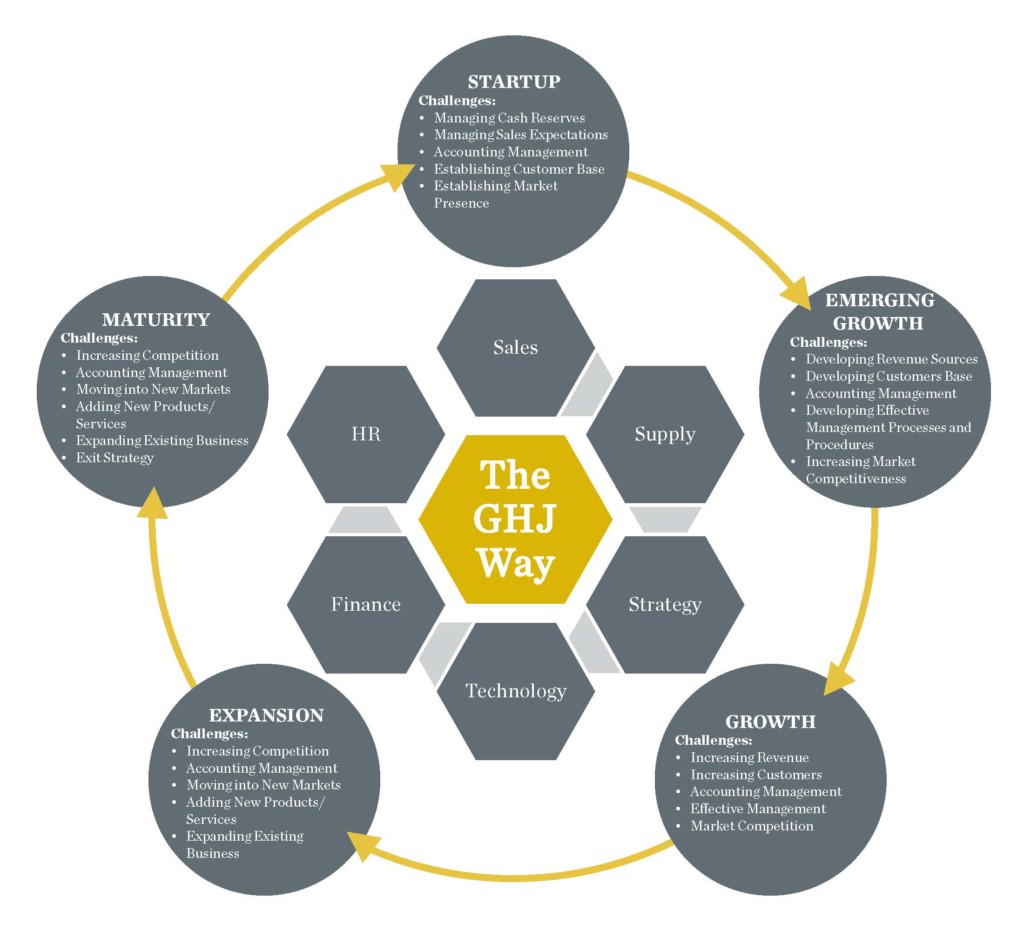

Our 30-year experience in looking at over 3,000 companies for transactional work and providing guidance has created a tried and true set of standards and perspective by which we analyze companies to help create additional value.

MAK: That sounds daunting. Where do you start?

David: We start by evaluating the depth, breadth and quality of the management team. Would we put this individual manager in front of a prospective buyer? Does he/she have the ability to communicate in depth about their functional area? Are they facile with numbers/customers/strategy? Have they done it before? We also slice and dice the company's financial statements, looking at things like customer concentration, margin by product/channel/customer/etc., contracts and other items specific to the company and industry.

Once we've completed our discovery work, we meet with a group of key managers and assemble granular financial projections with the view to creating a plan that can be managed to, and management held accountable to, whether or not in a transactional environment. After we’ve all created this plan together, we are then in a position to know exactly what pieces of the puzzle will be necessary to actually put the plan to work. The usual suspects are capital and improvements to management.

MAK: I’m imagining it can be difficult to get the decision-makers to agree throughout a process like this. What is the key to making it work?

David: Establishing discipline and maintaining credibility is the key. We’ve seen many businesses establish a plan, put it on the shelf and never look at it again. Our approach is to act as a guide while measuring those things that are important to measure, and adjusting when circumstances dictate. To the extent that the metrics we create are forward-looking enough, our clients actually are able to see when things are changing and are then in a position to make changes to react, or even better, proact. Once the team has agreed on the plan, we then forecast what it is the business will need to add (or subtract) in order to achieve the plan goals; most often this defines the need and amount of capital to be raised. Our process is also a teambuilding exercise and a way of discerning who is on and who is with the plan. We want everyone in the boat rowing in sync.

MAK: So now you’ve got the plan. Now what?

David: After completing the business model/plan, we then overlay the realistic options that are available to the ownership. These include an outright sale of the business, a recapitalization of the business to take chips off the table but retain control and growth without a transaction. We take into consideration the ownership’s individual and collective goals, their risk profiles, financial requirements and desires for employee retention. No situation is the same.

MAK: I’m sure that is very true! Since no two situations are the same, what’s the follow-up to this process? Is there another phase where you stay involved with the client?

David: After we’ve completed this initial phase of work, we often act in an advisory board capacity to provide additional “oversight” to meeting plan goals and adjusting the plan as things change. If our client wants to engage an investment banker to advise on a transaction, we have a process by which we can assist in identifying and selecting the right banker for each individual situation.

MAK: Is there a “symptom” or two that would alert a client it’s time to call you in and consider a value/growth strategic review?

David: When we hear things like “My partner and I are not on the same page,” “The plan in my head isn’t working the way it should,” “I see an opportunity but I don’t know how to capitalize on it,” or “Things are getting bigger than I know how to deal with,” it’s easy to start thinking about the lifecycle of a business to see where the company is. The hardest transition a business owner makes is that from being an entrepreneur/founder to being a growth manager. Delegating control is key.

MAK: Final word: What is the best advice you’ve ever gotten about how clients can add value?

David: Always hire the best people!