Accounting Standards Update (ASU) 2016-14, the new financial statement presentation for nonprofit (NP) entities, will become effective for many NPs this year (calendar year-ends) or in the following year (fiscal year-ends). What are the most important changes that our clients should be aware of and what do they actually entail?

Classification of Net Assets

We are moving away from three net asset classes (unrestricted, temporarily restricted and permanently restricted) to two net asset classes (with and without donor restriction).

NPs don’t need to make significant changes to their internal accounting systems. They should still keep track of restrictions of contributions and follow their policies. The only change will come into effect at year-end when the net assets have to be presented as with or without donor restrictions.

Investment Returns

Going forward, investment expenses (all external and direct internal) are netted against investment gains. In addition, the disclosure requirement for the composition of investment returns and expenses will be eliminated.

As with the net asset classifications, this new requirement should not change how NPs record investment returns or expenses. At year end, they should identify direct internal cost of managing investments (such as compensation paid for an in-house investment manager), as well as external costs and net them against investment returns for financial statement presentation purposes.

Expense Reporting

Currently, only voluntary health and welfare organizations are required to report information about expenses by their functional (program, management and general and fundraising categories) and natural classification. Once the new ASU comes into effect, all NPs have to report expenses by function and nature in a matrix format either on the face of the statement of activities, as a separate financial statement or as a schedule in the notes to financial statements. In addition, the allocation methodology between the functional categories will have to be disclosed.

For clients that already report their expenses by function and nature, this will only have a limited impact of more extensive disclosures. However, for all other NPs, they should reevaluate expense allocation methods and bases to ensure they are reasonable and still appropriate considering the current operations. Some possible allocation methods are time studies, square footage or direct use.

Reporting of Underwater Endowments

Currently, losses incurred on donor-restricted endowment funds that decrease the funds’ principal balances are presented as a decrease in unrestricted net assets following the principle that the permanently restricted endowment principal cannot be depleted. Under the new guidance, the accumulated losses will be included together with that fund in net assets with donor restrictions.

Organizations with underwater endowment funds will see changes in the respective balances of their net assets with and without donor restrictions as the accumulated losses are shifted to the restricted net assets category. In addition, the enhanced disclosures might influence a reader’s perception as the new presentation will make it clearer that the fund corpus has been depleted.

Liquidity Disclosures

NPs will be required to provide qualitative and quantitative information in regards to liquidity.

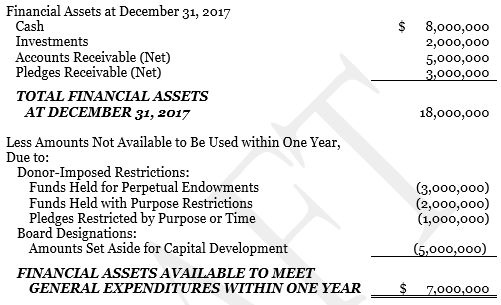

In the quantitative part NPs will have to communicate to the readers of the financial statements the financial assets at the balance sheet date that are available to meet the NP’s cash needs for general expenditures within one year. One way to analyze this would be to sum up all assets (excluding nonfinancial assets, such as prepaid expenses, property plant and equipment as these are not available for cash needs) and to then deduct any assets that are not available to be used within one year, such as funds with donor-imposed restrictions or board restrictions. Here is an example of what this quantitative disclosure would look like:

What does the bottom number really represent though? One way to analyze this amount could be to see how many month this amount could cover of expenses. Let us assume expenses for the fiscal year were $14,000,000. That would mean that the company had funds to cover six months of expenses.

The qualitative information part is where NPs could then describe in more detail what the numbers represent and how they manage their liquid available resources and their liquidity risk. For example, the following additional information could be disclosed:

- Are investments actively traded and could be sold to meet cash flow needs or are they invested in alternative partnerships or private equities with a 60-day liquidation notice requirement?

- What is the spending policy for the endowments and how are funds directed to be used?

- What is the process to use board designated reserves in case of an emergency?

- How does an organization budget its income and expenses? Is income primarily unrestricted or is a high portion of it restricted for specific programs and is not available for general operations?

- What plans are in place to meet unanticipated liquidity needs? Is there a line of credit facility that the NFP has access to?

...

As the changes will be effective within the next year for most NPs we recommend all our clients to be proactive in thinking about how these changes will affect their Financial Statements presentation and to reach out to their auditors for any advice or assistance that might be needed. If you want more information or need assistance with ASU 2016-14, contact the GHJ Nonprofit Team.