The Tax Cuts and Jobs Act of 2017 (TCJA) has made significant changes to the tax laws, including the enactment of sections 1400Z-1 and 1400Z-2, also known as the Opportunity Zones (OZ), in order to encourage investment into distressed and low-income communities throughout the United States. Under the OZ program, investors may generally defer tax on prior capital gains for a limited period of time, provided that such gain is reinvested in a Qualified Opportunity Fund (QOF). In addition, there are certain benefits if the investment is held for a certain number of years as discussed below.

What is an OZ?

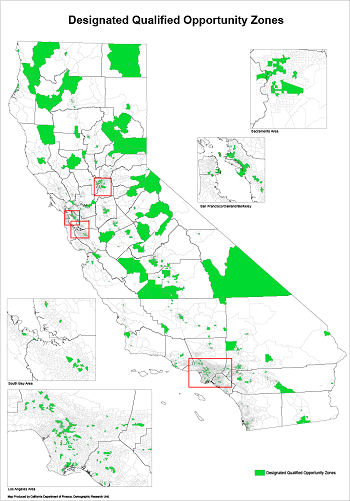

Under section 1400Z-1 of the Internal Revenue Code (IRC), an OZ is a population census tract that is a low-income community. To be qualified as an OZ, the governors of each state along with Chief Executive Officer of United States Territories have nominated certain areas. In California, 879 communities have been designated as OZ under Notice 2018-48. The full list is available at: http://dof.ca.gov/Forecasting/Demographics/opportunity_zones/

Source: California Department of Finance, Demographic Research Unit

What is a QOF?

In order to benefit from the program, an investor must invest in a qualified opportunity fund within 180 days after the sale or exchange of a capital asset. A QOF is an investment vehicle for investing in eligible property that is located in an OZ and that utilizes the investor’s gains from a prior investment for funding the QOF. The investor receives either stock or an interest in the QOF. The QOF must hold at least 90 percent of its assets in Qualified Opportunity Zone Property (“QOZP”) to remain a QOF.

What assets can be held?

A QOZP means property which is acquired after Dec. 31, 2017:

- Qualified opportunity zone stock – stock in a domestic corporation acquired by the QOF at its original issue, solely in exchange for cash. When the stock is issued, the corporation must qualify as a qualified opportunity zone business and remain one for substantially all of the holding period of the stock.

- Qualified opportunity zone partnership interest – a domestic partnership interest acquired by the QOF, solely in exchange for cash. The substantiality element of QOZ stock applies as well.

- Qualified opportunity zone business property – tangible property used in a trade or business of a QOF when the original use of such property commences with the QOF or the QOF substantially improves the property and substantially all of the use of the property was in a QOZ during substantially all of the QOF’s holding period.

How does it benefit investors?

Upon the sale or exchange of assets to an unrelated party, the investor has 180 days to reinvest the capital gain amount with a cash investment into a QOF. The tax incentive provided by the OZ program has three different aspects:

- The program allows a temporary deferral as the capital gain is not taxed before the tax year which includes the earlier of the date on which such investment is sold or Dec. 31, 2026.

- The program also recognizes a tax reduction with a step-up in basis for two different time periods.

- If the investor holds the interest in the fund for at least five years, they receive a basis increase in the investment that equals 10 percent of the deferred gain.

- If the investor holds the interest for an additional 2 years, there is an additional increase in basis of 5 percent.

- Finally, the program provides that if an Investor holds an investment for 10 years, the capital gains accrued on the Fund investment itself – i.e. the fund property’s profit will receive a full step-up in basis for that 10-year period. This final benefit results in a permanent exclusion of taxable income for investments into a Fund.

For example, Investor sells an investment on April 1, 2018 and realizes a $1,000,000 capital gain. He/She invests the gain on May 1 in a QOF. If the Investor holds his interest for five years, he/she gets a step-up in basis of $100,000. If the Investor keeps his/her interest two more years, he/she gets an additional $50,000 in basis.

If the Investor still holds his/her interest on Dec. 31, 2026, he/she will automatically recognize a $850,000 capital gain on that date. In addition, if the Investor continues to hold the fund investment through April 1, 2028, which would be for the full 10 years under the act, then the capital gain from the sale of the fund will be completely eliminated, and the only capital gain recognized would be the $850,000 capital gain recognized at Dec. 31, 2026. If the Investor ultimately sells his/her fund investment after 10 years for $2,000,000, he/she will have permanently eliminated $1,150,000 of capital gain.

Thus, an investor can permanently defer 15 percent of the initial capital gain and the entire appreciation from the fund investment provided the investment is held for 10 years.