Most companies are “elbows deep” in implementing the new revenue recognition standard. The new standard, ASC 606 - Revenue from Contract with Customers (which the FASB has been working on since 2014) represents the most significant change in accounting methodology in the past 20 years. The new standard is effective for private companies with annual periods beginning after December 15, 2018 (essentially for the year ended December 31, 2019). The new guidance is intended to improve comparability and transparency of financial statements, and it will affect every company and industry.

The objective of the new guidance is to create and help standardize how revenues are recognized across all industries to improve comparability and transparency, and supersedes previous industry-specific guidance. Furthermore, ASC 606 has the potential to significantly impact the way that revenue has been recognized historically, increase disclosure requirements and change the internal tracking and recording of revenues, especially when it is applied to technology and software companies.

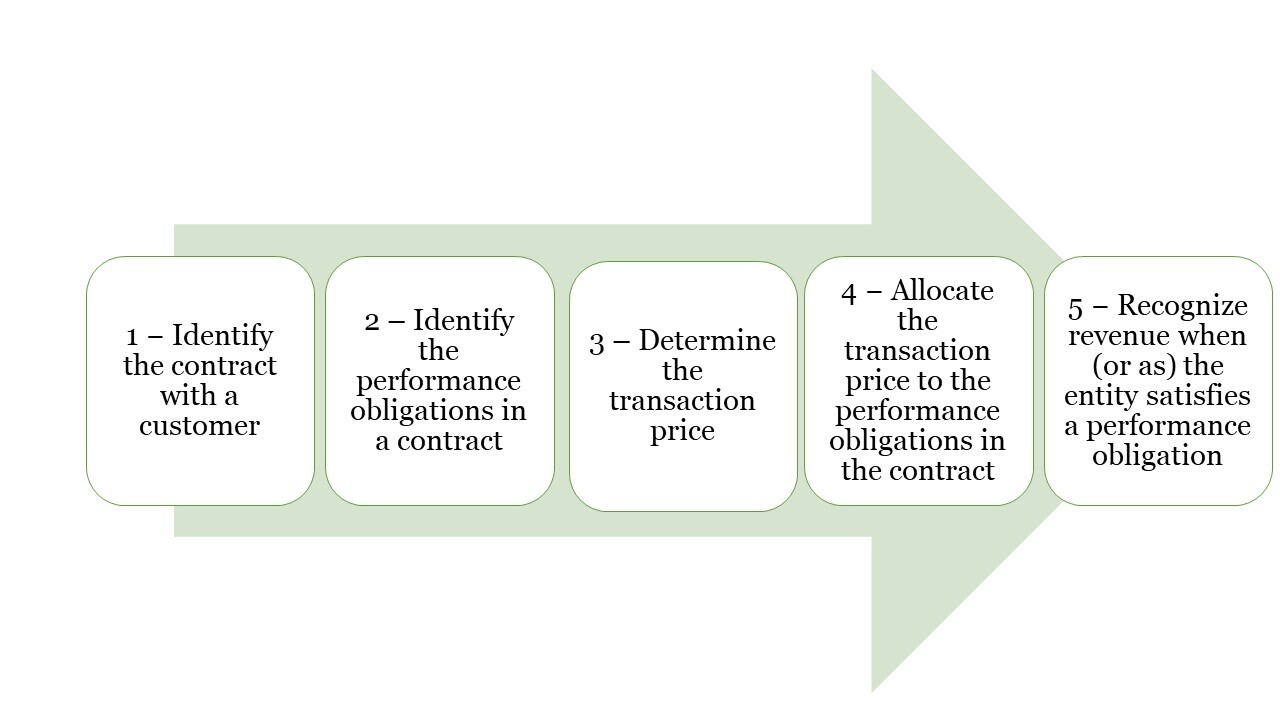

ASC 606 requires that entities analyze revenue streams utilizing the following five-step process:

All of the five steps listed have the likelihood to impact revenue recognition in Technology and Software companies, specifically in relation to the following areas:

Step 2: Identifying Performance Obligations: As a result of explicit requirements of what is considered “distinct” under the new revenue recognition guidance, there could be significant differences with how contract obligations were identified and how the transaction price was allocated under the previous guidance. This is especially prevalent in situations where a contract is to deliver software or a system, either alone or together with other products or services and may or may not include significant production, modification, or customization of software. In addition, there are often provisions in contracts to include training and ongoing maintenance. Depending on the provisions of the contracts, certain contract obligations may need to be accounted for separately.

Step 5: Timing of Revenue Recognition: Under the new guidance, specific performance obligations may need to be recognized at a “point in time” or over a “period of time," which may differ from how revenue was recognized under the previous guidance.

Licensed Content: Under the new standard, it is required that intellectual property be split between two distinct categories (functional vs. symbolic). Depending on the classification, the intellectual property may be recorded at a “point in time," which may advance revenue recognition, or “over-time”. Under each classification, there could be significant changes as to the timing in which revenues are recognized under licensed content transactions.

At GHJ, we are here to help you and your company navigate the complexities of the implementation of this new standard and with determining the impact to your year-end reporting to the users of your financial statements. To help clear up the confusion and learn the details of this new standard, contact Dan Landes at 310.873.6705.