The Tax Cuts and Jobs Act of 2017 enacted Section 951A of the Internal Revenue Code in order to prevent base erosion which requires a U.S. shareholder of any Controlled Foreign Corporation to include in gross income the Shareholder’s global intangible low-taxed income (GILTI). On June 21, the IRS and the Treasury Department published final regulations for the GILTI rules. In comparison to the proposed regulations published on October 10, 2018, the final regulations include changes which may impact U.S. taxpayers. One of the significant changes relates to the treatment of domestic partnerships for purposes of GILTI inclusions from controlled foreign corporations (CFC, as defined under Sec. 957(a)) owned by the domestic partnerships. Generally, a partnership may be treated as either an entity separate from its owners or as an aggregate of its partners. Under an aggregate approach, the partners of a partnership, and not the partnership, are treated as owning the partnership’s assets and conducting the partnership’s operations. Under an entity approach, the partnership is respected as separate from its partners. Therefore, the partnership, and not the partners, is treated as owning the partnership’s assets and conducting the partnership’s operations.

In addition, Subpart F regime which was created to limit the use of corporations organized in low-tax jurisdictions for the purpose of obtaining deferral of U.S. tax on certain earnings – primarily passive or mobile earnings is impacted by the published regulations.

The issue of how the GILTI determination is made and reported was addressed by the final regulations which included a change from treating the partnership as an aggregate of its partners for purposes of GILTI (and Subpart F inclusion) rather than as an entity which was the case under the proposed regulations.

This article discusses the new domestic partnership rules concerning GILTI and Subpart F provisions, as well as the potential implications to U.S. taxpayers.

Treatment of Domestic Partnerships under Final GILTI Regulations

The final GILTI regulations adopted an aggregate approach in determining a U.S. partner’s GILTI inclusion from a CFC owned by a partnership. Specifically, a domestic partnership is treated as a foreign partnership when determining a U.S. partner’s GILTI inclusions with respect to a CFC owned by the domestic partnership. In other words, if the partners of a partnership are not U.S. Shareholders (as defined in Sec. 951(b)) of a CFC owned by the partnership, the partners should not have GILTI inclusions with respect to the CFC. The aggregate approach also applies to S corporations.

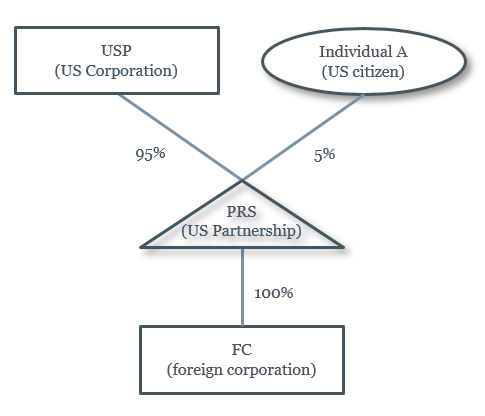

For example, USP (a U.S. corporation) and Individual A (a U.S. citizen unrelated to USP) own PRS (a domestic partnership) 95% and 5%, respectively. PRS owns 100 percent of FC (a foreign corporation, see the structure chart below). For purposes of determining the GILTI inclusion amounts for USP and Individual A, PRS is treated as a foreign partnership. As a result, USP is treated as owning 95% of FC and is required to include 95% of FC’s tested items for GILTI purposes. On the other hand, Individual A is treated as owning 5% of FC, whereas Individual A is not a U.S. Shareholder of FC. Individual A is not required to include tested item of FC for GILTI purposes.

Individual A is not treated as a U.S. Shareholder (as defined under Sec. 951(b)) of FC for GILTI purposes. Therefore, Individual A does not have tested items with respect to FC for purpose of computing Individual A’s GILTI inclusion.

USP is still treated as a U.S. shareholder of FC (as defined under Sec. 951(b)) for GILTI purposes. USP is required to include 95% of the tested items of FC for its GILTI inclusion.

As emphasized in the preamble of the final GILTI regulations, the aggregate approach for domestic partnership treatment is solely for GILTI purposes. For purposes of Subpart F income, the treatment of domestic partnerships is still under the entity approach. Using the example above and assuming FC has Subpart F income of $100. Under the entity approach, PRS is still treated as the U.S. Shareholder of FC, and thus both USP and Individual A are required to include their pro rata share of the Subpart F income as their gross taxable income. Note that the IRS also issued the proposed regulations to adopt the aggregate approach for Subpart F income purposes, which will be discussed later in this article.

For GILTI purposes, the aggregate approach of domestic partnership treatment should provide benefits to the U.S. taxpayers who own less than 10% a partnership’s CFCs (particularly for private equity fund investors or joint venture business owners). However, in certain circumstances, a partner of a domestic partnership who owns less than 10% of a CFC could still be subject to GILTI inclusions, particularly where there is a tiered partnership structure.

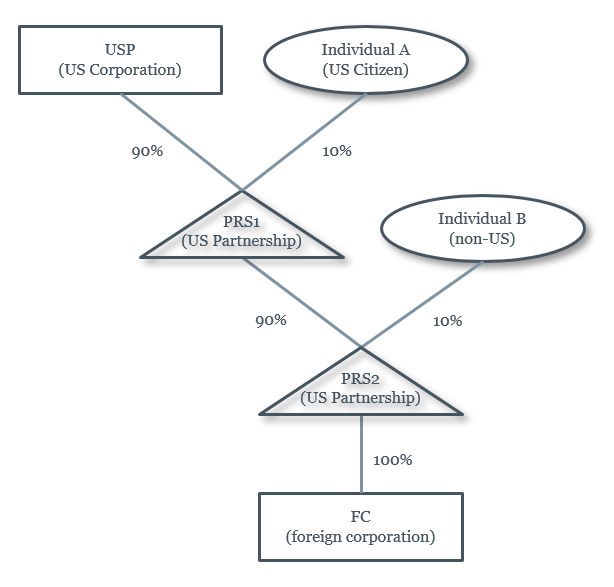

For example, USP (a U.S. corporation) and Individual A (a U.S. citizen) own a U.S. partnership PRS1 90% and 10%, respectively. PRS1 and Individual B (a nonresident of U.S.) own a lower-tier U.S. partnership PRS2 by 90% and 10%, respectively. PRS2 owns 100% of FC (a foreign corporation, see the structure chart below). Ultimately, Individual A owns 9% of FC (10% x 90%). However, for GILTI purposes, Individual A is still required to include 9% of the tested item of FC. Due to the constructive ownership rule under Sec. 958(b)(2), PRS1 is treated as owning 100% of FC for purposes of determining whether FC is a CFC to Individual A. As a result, Individual A is treated as owning 10% of FC (10% x 100% x 100%), and thus FC is a CFC with respect to Individual A. 9% of FC’s tested items would be included by Individual A for GILTI purposes.

Individual A indirectly owns 9% of FC. However, under the constructive ownership rules, Individual A is treated as owning 10% of FC for purposes of determining FC’s CFC status to Individual A. Therefore, FC is treated as a CFC to Individual A, who is then required to include 9% of FC’s tested items for GILTI purposes.

Ownership:

USP 90% of FC

A 10% of FC

GILTI inclusion:

USP 81% of FC GILTI

A 9% of FC GILTI

The effective date of the domestic partnership treatment for GILTI purposes retroactively applies to taxable years of foreign corporations beginning after December 31, 2017. For calendar year U.S. taxpayers who own calendar year CFCs, the domestic partnership rules would affect the 2018-year tax returns. If a domestic partnership filed its partnership tax return (Form 1065) and disclosed the GILTI amount on the K-1s to the partners who own less than 10% of a CFC, the partnership may need to amend the tax return and/or re-issue the K-1s. The U.S. partners, who own less than 10% of a partnership’s CFC and who reported the CFC’s GILTI tested income, should consider amending the 2018 return to reverse or adjust the GILTI inclusion amounts. The rules requiring consistency in filings by the partnership and the partners should be considered.

Proposed Regulations for Subpart F Aggregation Rules.

As briefly mentioned above, the current rules for inclusion of Subpart F income are under the entity approach while the GILTI inclusion is under an aggregate approach. To be consistent with the treatment of domestic partnership under the two provisions, the IRS also issued the proposed regulation 1.958-1(d) to adopt the aggregate approach for Subpart F income rules. Under the proposed regulations, stock owned by a domestic partnership will generally be treated as owned proportionately by its partners for purposes of sec. 951(a) and 951A. For example, assuming the same facts of the first example above except that FC also has a Subpart F income of $200. Under the proposed regulation 1.958-1(d), Individual A would not be required to include the 5% of Subpart F income of FC as Individual A is not a U.S. shareholder of FC.

The proposed aggregate Subpart F approach is welcomed by most U.S. taxpayers; otherwise, the mismatch treatment of Subpart F and GILTI could cause substantial complexity and uncertainty (e.g., foreign tax credit, previously taxed earnings and profits tracking, basis adjustments). However, there are also some concerns as related to the other provisions, such as Passive Foreign Investment Company (PFIC) overlap rules. If a partnership owns a foreign corporation which is a CFC and a PFIC at the same time, the CFC rules control and PFIC rules essentially do not need to be considered. However, under the proposed regulations, the minority partners of the partnership who are not defined as U.S. Shareholders of the foreign corporation would be subject to PFIC regime. This issue could give rise of a series of adverse consequences to U.S. investors of private equity funds that hold passive foreign investments.

The proposed regulation 1.958-1(d) applies to taxable years of foreign corporations beginning on or after the date of publication of the Treasury decision adopting these rules as a final regulation in the Federal Register. However, U.S. taxpayers could make an election to “early adopt” the proposed regulations to apply to taxable years of a foreign corporation beginning after December 31, 2017. Although there are benefits for electing early adoption (e.g., less than 10% U.S. partners could avoid Subpart F/Sec. 956 inclusion), there are a few significant concerns: (1) domestic partnership, partners that are U.S. Shareholders of CFCs, and related domestic partnerships must consistently apply the aggregate approach to all CFCs, (2) the basis adjustment rule of the partnership interest to U.S. partners is not yet clear, and (3) potential PFIC issues could create adverse result for the less than 10% U.S. partners. Modeling of the results is highly recommended in order to make a determination for whether an election should be made.

Observations

Previously, U.S. private equity funds tended to form the holding companies (e.g., limited partnership) in foreign jurisdictions to avoid potential Subpart F income and GILTI inclusion issues, as foreign partnerships, have been treated as aggregate under the statute (Sec. 958(a)(2)). Given the final GILTI regulations and proposed Subpart F aggregation regulations, private equity funds may consider being formed in the U.S. without triggering Subpart F income or GILTI to certain U.S. investors.

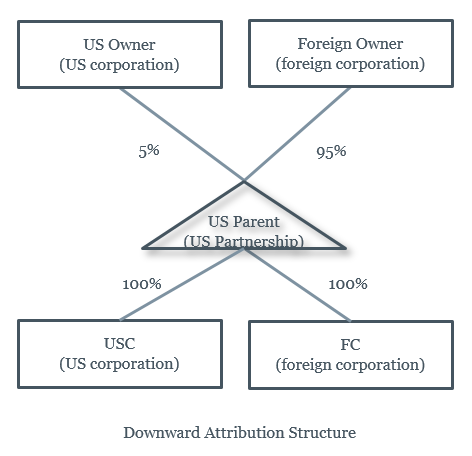

Although the proposed regulation Sec. 1.958-1(d) provides relief for Subpart F and GILTI to the minority partners of partnerships that owns CFCs, the impact of the downward attribution rule still exists which may trigger adverse Subpart F and GILTI issues to certain U.S. shareholders. For example, as depicted on in the Downward Attribution Structure below, U.S. Owners (a U.S. corporation) and Foreign Owner (a foreign corporation) own U.S. Parent (a U.S. partnership) 5% and 95%, respectively. U.S. Parent wholly owns USC (a U.S. operating corporation) and FC (a foreign operating corporation). Because of the downward attribution rule (i.e., the repeal of Sec. 958(b)(4) under the 2017 Tax Cut and Job Act), U.S. Parent’s ownership in FC is downward attributed to USC. FC is wholly owned by USC for purposes of determining FC’s CFC status, and thus FC is a CFC. Under the proposed regulation Sec. 1.958-1(d), U.S. Owner should not be treated as a U.S. Shareholder of FC. Therefore, U.S. Owner should not be subject to Subpart F income and GILTI inclusion to FC.

However, if U.S. Owner owns 10% or more interest of U.S. Parent, it should be treated as a U.S. Shareholder of FC and be subject to both Subpart F and GILTI provisions to FC.

Importantly, the state tax implications should also be carefully reviewed, particularly regarding the states that do not or partially conform to the federal rules.

Next Steps

Do these regulations apply to you and your business? The recent changes could pose an impact to many taxpayers. If you have immediate questions or need further guidance, feel free to contact GHJ advisors at 310.873.1600.