Grants and contributions – rather than earned income from contracts with customers – make up the majority of income for many nonprofit organizations, so it is not surprising that the new clarifying standard for contributions received and made will have a wide-ranging impact. This blog is the second part of our blog series covering the implementation considerations of the new standard and focuses on the recipients of grants and contributions.

Background:

In June 2018, the Financial Accounting Standards Board (FASB) released Accounting Standards Update (ASU) 2018-08, Clarifying the Scope of the Accounting Guidance for Contributions Received and Contributions Made. The ASU clarifies the accounting guidance for grants and contracts of nonprofit organizations (NFPs) particularly in regard to the determination of whether a transaction is reciprocal or non-reciprocal, as well as more clearly defines conditions versus restrictions. The guidance is effective for all entities who make or receive grants or contributions.

Effective date and Transition:

Most nonprofits who receive grants and contributions will implement the standard in the year beginning after Dec. 15, 2018 (calendar year 2019 or fiscal year end 2020). The transition to the new standard is on a prospective basis, where only the unreleased portion of remaining agreements is recognized under the new standard and prior year results are not restated. Retrospective application is permitted as well.

Key Changes:

The new standard brings a streamlined approach to assessing how to account for the funds received through a series of steps:

- Step 1: Is the transaction one in which each party directly receives commensurate value?

Examples of direct value received by the resource provider include rights to the product of the NFP's activity such as research, or products and services directly benefitting the resource provider. If the resource provider receives direct value, the transaction is reciprocal and should be accounted for under the scope of ASC 606 Revenue from Contracts with Customers. If no direct value is received by the resource provider, the transaction is non-reciprocal and is within the scope of ASU 2018-08. Key considerations:

- The following types of transactions would not be considered reciprocal:

- Transfers of assets from government agencies that are part of an existing exchange transaction between a recipient and an identified customer are considered reciprocal transactions (e.g. a Medicaid payment from the State Government to a clinic for a specific patient or a Pell Grant payment to a university for a specific student would be considered exchange or reciprocal transactions).

- If the value is received by the resource provider indirectly (i.e. providing benefit to a group of individuals, overall society, etc.).

- If the value received is the execution of the resource provider's mission (e.g. if the Department of Mental Health awards a grant to a NFP to serve individuals with mental illnesses, the individuals served by the NFP directly benefit from the grant, not the resource provider, which in this case is the Department of Mental Health).

- If the value received by the resource provider is incidental to the potential public benefit (e.g. a corporation makes a monetary donation to a Museum for its new art exhibition, and the Museum displays the donor’s name next to the exhibit. The potential value of marketing benefits received by the corporation is incidental to the benefit received by the general public attending the Museum).

Considering the examples and the logic in this step, the most significant impact of the new guidance appears to be with the treatment of government grants. Prior to the new standard, it was common industry practice to treat grants and contracts with government agencies as exchange transactions, following the rationale that the government does not make contributions. Under the new guidance, the type of the resource provider is irrelevant in determining the accounting treatment.

- Step 2: Is the contribution conditional?

If the transaction is determined to be non-reciprocal, the next question is whether it is conditional. In order to be conditional, the agreement must include both of the following: (1) a right of return/release and (2) a performance-related condition or other measurement barrier.

What is a right of return/release? A right of return or release allows the resource provider/grantor to withhold the payment of the grant or receive a refund if grant stipulations are not met by the recipient. The grant agreement does not need to use the exact terminology “right of return/release” and may reference another document that is referenced by the grant agreement.

- The standard "right of return" clause is included in many agreements as a matter of policy and would not make the contribution conditional unless it is tied to a specific barrier to be overcome. For example, the provision that the grantor may request the return of funds if they are not spent for the intended purpose or if the grantor is not satisfied with the progress of the grant recipient's work under the grant would not make the grant conditional.

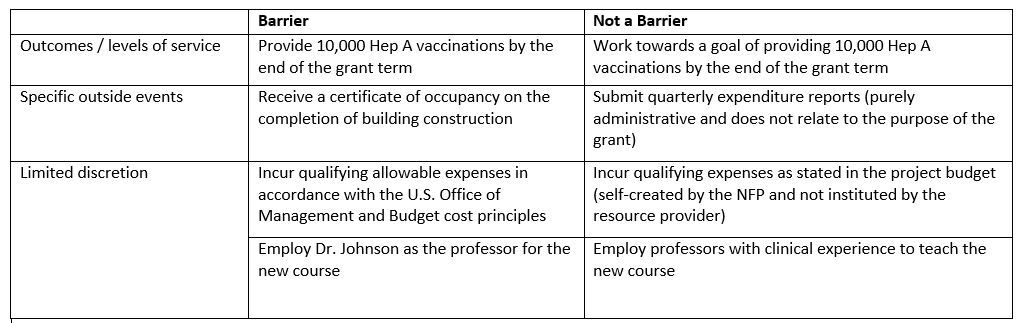

What is a performance-related or other measurement barrier? These are specific barriers to be overcome by the resource recipient to be entitled to funds. Examples of barriers include:

- Specific outcomes, units of output, or levels of services to be achieved;

- Specific events outside of the resource recipient's control;

- Limited discretion on how to perform the activity under the grant

The following is a guide for most common clauses included in grant agreements:

Contributions determined to be unconditional are recognized upon the receipt of the legally enforceable agreement or payment, whereas the recognition of conditional contributions is deferred until the conditions are met.

Key considerations:

- An assessment of the likelihood or probability of meeting the conditions is not relevant under the new standard. Whereas before contributions could be recognized as unconditional if the NFP believed it was probable the conditions specified in the agreement would be met, now this is no longer allowed under the new standard.

- If the donor stipulations are ambiguous, the contribution is presumed to be conditional.

- Step 3: Is the contribution restricted? The contribution is considered restricted if it is given for a purpose that is narrower than the overall mission of the resource recipient.

- Example: the organization whose primary mission is to serve burn victims receives a grant covering the medical costs of after-burn treatment. This would be considered an unrestricted contribution. If the organization receiving the grant had other programs, such as providing fire safety education, running social rehabilitation workshops, etc.; the same contribution would be considered restricted to the program of treating the burn victims.

Key considerations:

- Prior to the new standard, most government grants were recorded as unrestricted exchange transactions. Under the new standard, these transactions might become restricted contributions, and the statement of activities might look different and present challenges when budgeting.

- The new standard provides for a policy election of the simultaneous release option. If elected, this policy would allow NFPs to recognize restricted grants that are received and released in the same period as without donor restrictions without having to show the restricted contribution and the release from purpose restrictions on the statement of activities.

Final Thoughts:

Organizations receiving government grants will see the most impact from implementing the new standard. In order to streamline the process, follow these steps:

- Assess all revenue streams in relation to this new standard, as well as ASC 606, to understand how revenue recognition might change under these new standards and how it will impact your statement of activities.

- When applying for grants, if possible, consider negotiating with resource providers on the terms that would result in the most beneficial treatment of the funding.

- Adopt the simultaneous release option for recognition of restricted grants spent in the same period to simplify the presentation of the statement of activities.

- Train your finance and development staff on the new standard so that the implementation is smooth and there are no surprises at year-end.

- Keep your board and finance committee updated on what the new standard will mean for the statement of activities to ensure clarity in budgeting.