COVID-19 has opened up the world of remote working and the number of remote workers has jumped in recent months. While state and local orders continue to require that certain employees work remotely or telecommute during the pandemic, employers may now see an increase from employees working remotely on an extended basis. This is due to the numerous benefits (such as reduced expenses on office space, higher productivity, greater flexibility and overall job satisfaction) companies and employees have experienced with moving to a remote environment. However, whether the option to work from home is the employee’s choice or a result of state and local restrictions, employers may see an increase in their burden from a state and local tax standpoint. The federal government and certain state governments, however, are looking to make changes to decrease this burden in light of COVID-19.

Highlights of State Tax Nexus

In general, companies are considered to have nexus in a state for all taxes imposed by that state (e.g., income, franchise, gross receipts, sales/use and payroll) if they have employees working in the state.

- Prior to COVID-19: Many states asserted nexus over employers due to the in-state presence of a single home-office employee.[1] In addition, some states take this position as a matter of state statute.[2]

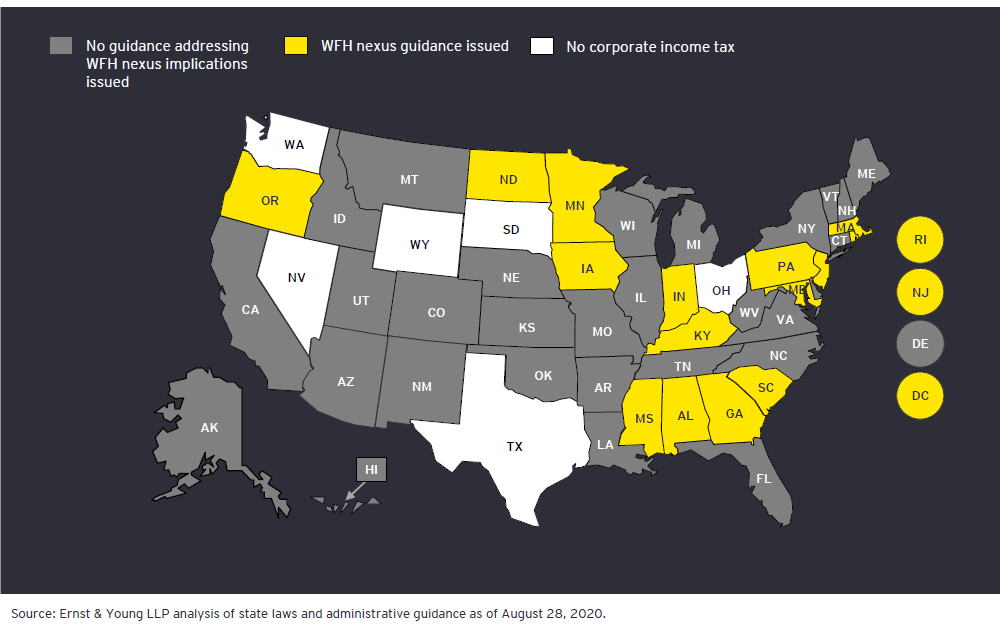

- Post COVID-19: For the first time, employers may find themselves with employees performing significant work in a new state as more employees choose to work remotely. While states can assert nexus over companies who have an in-state physical presence there due to employees working from home, many states have explained that due to COVID-19 they will not assert nexus over a company solely due to such a connection with the state. But, this will differ state by state and should be reviewed closely.

A remote workforce can dramatically affect a company’s state tax nexus footprint. In addition, some businesses may have had nexus in a state, but were otherwise not subject to an income tax liability because of Public Law (P.L.) 86-272.[3] With longer-term physical presence, and activity exceeding the limitations of P.L. 86-272, these companies may now have income tax exposure.

COVID-19 Telecommuting Issues and State Relief Initiatives

For state individual income tax and related payroll withholding purposes, employees’ wages for the performance of personal services are generally sourced to the state where they physically performed the work. In the case of telecommuters, this generally means that payroll withholding is due to the state from which they telecommute, regardless of the location of the employer.

However, the states that have adopted the “Convenience of the Employer” test (Connecticut, Delaware, Georgia, Massachusetts, Mississippi, Nebraska, New York, New Jersey, Pennsylvania and South Carolina), wages of remote workers are sourced to the employer’s location unless the employee can demonstrate that the remote working arrangement was done for the employer’s necessity, not the employee’s convenience.

Similarly, certain states (District of Columbia, Indiana, Massachusetts, Mississippi, New Jersey and Pennsylvania) have waived enforcement of certain sales tax nexus laws for employees temporarily working from home during the pandemic.

States with three-factor apportionment formulas may assert that compensation paid to employees working in the state creates a payroll factor numerator in the state.[4] The in-state presence of a home office employee may also affect a company’s sales apportionment factor. For example, some states require revenue from sales other than of tangible personal property to be sourced to the state where the underlying income-producing activity occurs (based on cost of performance rule). Such states may assert that the compensation paid to employees who are telecommuting from their state require some of the employer’s revenue to be sourced in the state.

Scenarios where source income may change due to in-state apportionment rules:

- Changes in distribution networks (and where inventory is stored) may alter apportionment based on the origin and/or destination of tangible property

- Closures of retail locations may shift demand to e-commerce, which may shift apportionment based on the customer’s shipping address and product destination

- Service providers working from home may need to review state source income in cost of performance states

- Customers of service businesses may be located in a different location than their usual place of business, which may impact market-based sourcing and where the benefit of a service is received

Federal Bills Proposed to Address State Tax Complications

In July, provisions of S.3995 were proposed with the Health, Economic Assistance, Liability Protection and Schools (HEALS) Act. While not yet passed, the proposed bill clarifies that nexus is not created by an employee working in a state for an out-of-state business in light of the employee tax withholding and nexus issues arising from the COVID-19 pandemic. The other highlights are as follows:

- Sets forth the essential protections of the Mobile Workforce Act

- Applies to all taxing jurisdictions within the territorial limits of the United States

- Expands the proposed 30-day safe harbor to 90 days for the 2020 calendar year

- Safeguards against apportionment and sourcing issues resulting from remote employees working out-of-state

- Provides employers with the option to either continue withholding at the employee’s usual place of work or switch withholding to where the employee is working remotely during the pandemic until Dec. 31, 2020, or when the employer allows the employee and at least 90 percent of the workforce to return to their usual place of work

- Sunsets on Dec. 31, 2024

A similar bill H.R. 5674 is also proposed, which contains the provisions of the Federal Mobile Workforce State Income Tax Simplification Act (Mobile Workforce Act) of 2020. The bill exempts employers from state income tax withholding and information reporting requirements for employees not subject to income tax in the state. This bill prohibits the wages or other remuneration earned by an employee who performs employment duties in more than one state from being subject to income tax in any state other than (1) the state of the employee's residence, and (2) the state within which the employee is present and performing employment duties for more than 30 days during the calendar year. This bill explicitly does not provide guidance for sales tax nexus.

Another bill to note is H.R. 7968 with a similar concept, the Multistate Worker Tax Fairness Act. This bill would limit the extent to which states may tax the compensation earned by nonresident telecommuters and other multi-state workers.

What to Expect Going Forward

The new remote workforce environment caused by the COVID-19 pandemic requires companies and their employees to evaluate the potential state income tax consequences of the remote work arrangements, including nexus and apportionment issues. Although some states have provided guidance on remote workforces, other states may still consider businesses to have nexus due to the fact that a single employee is working from their state. In addition, some states may not consider that such employee creates nexus for income tax purposes however, the same employee may establish nexus for sales tax and payroll tax withholding requirements.

Considerations post-COVID-19 include:

- Timing of expiration of exemptions due to COVID-19 and communication to employers and employees

- Inconsistencies of states or localities when exemptions expire

- Navigating work-from-home for more employees on a long-term basis

- Complexity of multi-state withholding if the simplification bills are not passed

- Understanding case-specific issues for employees’ health and safety returning to an office

Again, the COVID-19 relief is temporary, and the long-term remote worker may still establish nexus, which will require several tax filings because of state and local tax compliance for businesses.

GHJ recommends companies keep contemporary records of where employees are working and review state income, sales and payroll tax nexus on a periodic basis (three to six months) due to frequently changing state tax rules

If you have questions about the above, GHJ’s COVID-19 Response Team is as an experienced group of consultants specializing in tax issues, cash-flow projections, strategy and operations consulting and re-organizations. We are here to assist businesses to succeed in these very challenging times.

[1] See, e.g., Appeal of Warwick McKinley, Inc., Cal. State Bd. Equal. No. 489090 (Jan. 11, 2012) (imposing corporate income tax nexus over a Massachusetts corporation due to the in-state presence of one home office employee).

[2] See, e.g., Minn. Stat. § 297A.66 Subd. 1(a) (1) (asserting sales tax nexus over any retailer or marketplace provider who has or maintains within the state, “an office … including the employment of a resident of this state who works from a home office in this state”).

[3] P.L. 86-272 is a federal law that allows a business to send representatives into a state to solicit orders for goods without being subject to a net income tax in the state, as long as these orders are approved by the business outside the state.

[4] Apportionment refers to the ratio used for state income tax purposes to allocate taxable income to a state. Three-factor implies a property, payroll, and sales factor ratio to be considered. Single-factor implies a sales factor only is used to source revenue.