If you are involved in the finance function at your company, you have likely heard about changing revenue recognition rules. The FASB has been working since 2014 on a massive overhaul to the revenue recognition model, and it is finally here. The final standard (ASC 606 – Contracts with Customers) is effective for private companies beginning with fiscal years ending Dec. 31, 2019. This change represents the most significant change in accounting methodology in 20 years. The new guidance is intended to improve comparability and transparency of financial statements, and it will affect every company and industry.

What has changed?

ASC 606 is a principle based model and removes much of the industry-specific guidance that companies in certain industries (such as engineering/construction, real estate and software) used to rely upon to determine the appropriate timing for recognizing revenue.

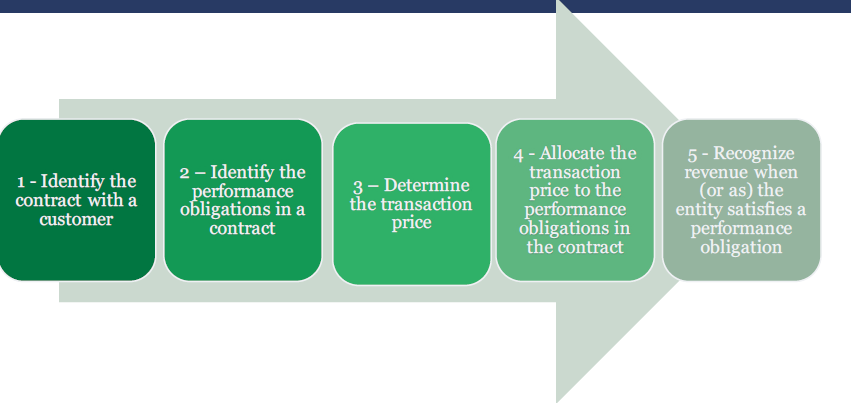

Instead, ASC 606 has a five-step approach to revenue recognition that is to be followed by every industry:

- Identify the contract with a customer

- Identify all performance obligations in the contract

- Determine the transaction price(s)

- Allocate the transaction price(s) to the performance obligations in the contract

- Recognize revenue when (or as) the entity satisfies a performance obligation

How will this impact the food and beverage industry?

Based on GHJ’ experience, the most significant impact of the new standard for companies in the food and beverage space will be in the determination of the transaction price based upon what is referred to as “variable consideration.” Variable consideration includes items such as discounts/coupons, rebates, refunds, price concessions and slotting fees. In the past, food and beverage companies could account for items such as these by recording them as incurred or recording reserves or other estimates over time. Under ASC 606, these items must be assessed as potential reductions in the transaction price of a contract based on the terms and the company’s estimates and historical activities. This assessment can be very subjective and will require companies finance departments thoughtful attention to review significant contracts and update accounting policies accordingly.

In addition to these “nuts and bolts” changes to the mechanics of revenue recognition, the standard also calls for various new financial statement disclosures which can be challenging.

GHJ’s Food and Beverage Team is here to help you and your company navigate through the complexities of the implementation of this new standard and with determining the impact to your year-end reporting to the users of your financial statements.